In today’s job market, the terms “hourly” and “salary” are often used to describe different payment structures. While hourly employees are paid based on the number of hours worked, salaried employees receive a fixed income regardless of the time spent on the job. Many people wonder how to convert their hourly wage into a salary, especially when considering new job offers or negotiating a pay raise. In this article, we will dive deep into how you can accurately calculate your hourly to salary conversion.

Whether you are considering a career change, or simply curious about the financial implications, this guide on converting hourly to salary will walk you through all the essential details.

What is an Hourly Wage?

An hourly wage is a payment structure where workers are paid based on the number of hours they work. Typically, hourly workers are compensated at a set rate per hour, and they may also be eligible for overtime pay. Overtime pay is typically paid at a higher rate for hours worked beyond 40 hours in a week, often 1.5 times their regular hourly rate.

Hourly positions are common in industries such as retail, hospitality, construction, and manufacturing, where work is often based on shifts or fluctuates depending on the season or demand.

What is a Salary?

A salary is a fixed annual amount of pay. It is usually divided into 12 monthly payments or bi-weekly payments. Unlike hourly workers, salaried employees receive the same amount of money each pay period, regardless of the number of hours worked. Salaried employees are often not eligible for overtime pay, though this can vary depending on the industry and specific job.

Salaried positions are more common in corporate, managerial, and professional roles where the focus is on completing specific tasks or meeting job expectations rather than working a set number of hours.

Why Convert Hourly to Salary?

There are several reasons why you might want to convert your hourly wage into an annual salary:

- Comparing Job Offers: If you are considering switching from an hourly job to a salaried position, understanding your hourly to salary conversion will help you compare job offers more accurately.

- Budgeting: Knowing your annual salary helps with financial planning, as it provides a clear understanding of your expected earnings over a year.

- Salary Negotiations: If you are an hourly worker looking to negotiate a salaried position, understanding your hourly to salary conversion gives you a baseline figure to negotiate from.

How to Calculate Hourly to Salary Conversion

To calculate your hourly to salary conversion, you need to follow a simple formula. The key factors in the calculation are:

- Hourly Wage: The amount you earn per hour.

- Work Hours per Week: The number of hours you work each week.

- Work Weeks per Year: The number of weeks you work in a year, typically 52 if you work full-time without extended time off.

Formula for Hourly to Salary Conversion

The formula for converting an hourly wage to an annual salary is as follows:

Annual Salary = Hourly Wage × Hours per Week × Weeks per Year

For example, if you earn $20 per hour and work 40 hours per week for 52 weeks in a year, your hourly to salary conversion would be:

Annual Salary = $20 × 40 × 52 = $41,600

This means that an hourly wage of $20 would translate to an annual salary of $41,600.

Accounting for Overtime in Hourly to Salary Conversion

If you work overtime, your hourly to salary conversion will require some additional calculations. Overtime is typically paid at 1.5 times the regular hourly rate for any hours worked beyond 40 in a week. To account for overtime in your hourly to salary conversion, you can calculate the additional earnings from overtime and add that to your base salary.

For example, if you work 10 hours of overtime every week at a rate of $30 per hour (1.5 times your regular rate of $20), your overtime pay would be:

Overtime Pay = $30 × 10 × 52 = $15,600

Add this to your base salary:

Annual Salary with Overtime = $41,600 + $15,600 = $57,200

So, if you regularly work 10 hours of overtime per week, your hourly to salary conversion would result in an annual salary of $57,200.

Hourly to Salary Conversion with Paid Time Off (PTO)

If you receive paid time off (PTO) such as vacation days, holidays, or sick leave, you can calculate your hourly to salary conversion to include this time off. In this case, you would reduce the number of weeks worked by the amount of time you take off while still being paid.

For example, if you receive two weeks of paid vacation and work 40 hours per week at $25 per hour, your hourly to salary conversion would be:

Annual Salary = $25 × 40 × (52 - 2) = $25 × 40 × 50 = $50,000

This means that taking two weeks of paid vacation results in an annual salary of $50,000.

Part-Time Workers: Hourly to Salary Conversion

Part-time workers can also benefit from understanding their hourly to salary conversion. Since part-time employees often work fewer than 40 hours a week, their hourly to salary calculation will look a bit different.

For example, if you work 25 hours a week and earn $15 per hour, your hourly to salary conversion would be:

Annual Salary = $15 × 25 × 52 = $19,500

This calculation shows that working part-time with an hourly rate of $15 results in an annual salary of $19,500.

Key Factors to Consider During Hourly to Salary Conversion

When calculating your hourly to salary conversion, it’s important to account for several key factors that may influence your earnings:

- Overtime: If you regularly work overtime, factor this into your calculations, as it can significantly boost your overall earnings.

- Paid Time Off (PTO): Consider any vacation, holiday, or sick leave you are entitled to, as this can affect your total working weeks.

- Bonuses and Incentives: Some salaried positions offer bonuses, commissions, or incentives that may not be reflected in the base salary. Be sure to include these in your overall earnings calculation.

- Benefits: Benefits such as health insurance, retirement contributions, and other perks are often part of salaried positions. While they don’t directly impact your hourly to salary conversion, they add to the overall value of the job.

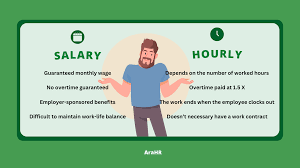

Advantages and Disadvantages of Hourly and Salary Pay

Hourly Pay:

- Advantages:

- More control over hours worked.

- Overtime pay for additional hours.

- Can lead to higher earnings during busy periods.

- Disadvantages:

- Income is not guaranteed, especially during slow periods.

- May not include benefits such as health insurance or retirement.

Salary Pay:

- Advantages:

- Stable and predictable income.

- Often comes with additional benefits like health insurance, retirement plans, and PTO.

- Disadvantages:

- No overtime pay, even if you work extra hours.

- May require working longer hours without additional compensation.

Conclusion: Mastering the Hourly to Salary Conversion

Understanding your hourly to salary conversion is essential for making informed decisions about your career and finances. By using the simple formula provided, you can easily calculate how much you would earn annually based on your hourly wage. This knowledge is especially useful when comparing job offers, budgeting for the future, or negotiating a salary increase.

Whether you’re an hourly worker contemplating a shift to a salaried role, or you just want a clearer picture of your finances, mastering your hourly to salary conversion can provide clarity and confidence as you navigate your career path.

Now that you know how to convert your hourly to salary, you can make more informed decisions and ensure that your compensation aligns with your financial goals.